Mullen Automotive Inc MULN Stock Price Today, News, Quotes, FAQs and Fundamentals

30 December 2022Contents:

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

Fundamentally, as a burgeoning sector, the price for entry for arguably most co… Shares of Mullen Automotive Inc. charged 16.1% higher in very active morning trading Tuesday. The electric vehicle maker’s stock has already traded in a range of up 6.6% at the intraday low of $1.13, to up 35.8% at the hi… The markets may be showing solid signs of improvement, but there are still many stocks to sell.

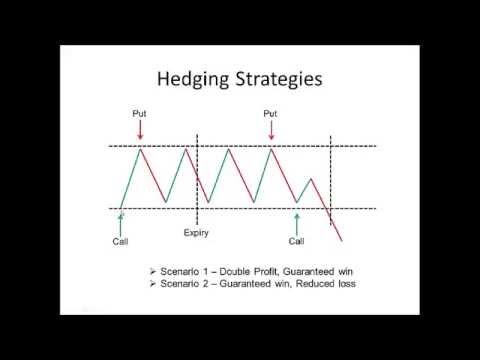

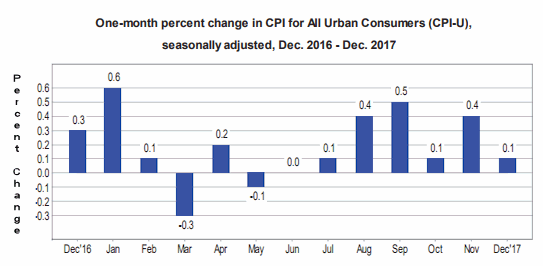

Many investors are betting on an inflation peak. Here’s why a former hedge-fund manager says they’re wrong.

The Company owns and partners with several synergistic businesses, all working towards the same goal of creating clean and scalable electric vehicles and energy solutions. The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company. It’s calculated by dividing the current share price by the earnings per share . It can also be calculated by dividing the company’s Market Cap by the Net Profit. While electric vehicles may be the future of transportation, I’m afraid these EV stocks to avoid might not make the cut.

Mullen Automotive Stock Forecast Is MULN a Good Stock to Buy? – Capital.com

Mullen Automotive Stock Forecast Is MULN a Good Stock to Buy?.

Posted: Mon, 08 Aug 2022 07:00:00 GMT [source]

These are established companies that reliably pay dividends. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days.

MULN Stock: Why You Shouldn’t Bet Against This EV Innovator

Mullen Automotive Inc 50-day moving average is $0.1473. Mullen Automotive Inc is engaged in manufacturing electric vehicles and energy solutions. The company strives to make electric vehicles more accessible by building an end-to-end ecosystem that takes care of all aspects of electric vehicle ownership.

In fact, in this environment of elevated interest rates, stocks with unrealistically high valuations are… Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. Intraday Data provided by FACTSET and subject to terms of use.

Morningstar‘s Stock Analysis MULN

It attempts to reflect the cash profit generated by a company’s operations. Mullen Automotive Inc. shares rose more than 20% on Friday, bringing weekly gains to more than 100%, after the southern California electric-vehicle startup was featured in a couple of news outlets this week. A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Represents the company’s profit divided by the outstanding shares of its common stock. Provide specific products and services to you, such as portfolio management or data aggregation.

MULN: MULN vs. GM: Which Is the Better EV Buy? – StockNews.com

MULN: MULN vs. GM: Which Is the Better EV Buy?.

Posted: Thu, 05 Jan 2023 08:00:00 GMT [source]

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their free power of attorney form is clear and in no way misleading or deceptive. Verify your identity, personalize the content you receive, or create and administer your account. CompareMULN’s historical performanceagainst its industry peers and the overall market. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. APAC+ It’s been a half century since Australia and China established formal relations, but neither side is really celebrating.

Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. Market cap, also known as market capitalization, is the total market value of a company. It’s calculated by multiplying the current market price by the total number of shares outstanding. Mullen Automotive Inc market cap is $291.62M. We sell different types of products and services to both investment professionals and individual investors.

Markets

Other market data may be delayed by 15 minutes or more. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. I’d be tempted to plow it into research and development (R&D) at an electric vehicle startup. 52 week low is the lowest price of a stock in the past 52 weeks, or one year.

NIO: 3 EV Stocks Investors Should Pump the Brakes On – StockNews.com

NIO: 3 EV Stocks Investors Should Pump the Brakes On.

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

https://1investing.in/ Automotive Inc 52 week low is $0.0657 as of April 29, 2023. 52 week high is the highest price of a stock in the past 52 weeks, or one year. Mullen Automotive Inc 52 week high is $1.71 as of April 29, 2023. Sign Up NowGet this delivered to your inbox, and more info about our products and services.

After several years of growing tensions, the potential for a reset under Australia’s new Labor government is in question as trade sanctions remain and diplomatic disputes persist. Investors have been scared out of this group of stocks, says fund manager, who offers five ideas for the rebound to come. Create a list of the investments you want to track.

Laying Out the Bear Case for Mullen Automotive Stock

This involves the identification of the wors… Measures how much net income or profit is generated as a percentage of revenue. Join thousands of traders who make more informed decisions with our premium features.

- They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

- The company strives to make electric vehicles more accessible by building an end-to-end ecosystem that takes care of all aspects of electric vehicle ownership.

- Historical and current end-of-day data provided by FACTSET.

- It’s calculated by multiplying the current market price by the total number of shares outstanding.

Real-time quotes, advanced visualizations, backtesting, and much more. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Mullen Automotive Inc. said Wednesday it will partner with Loop Global Inc. to build public and private electric vehicle charging technology, infrastructure and network solutions. EBITDA is a widely used measure of corporate profitability. It stands for Earnings before Interest, Taxes, Depreciation, and Amortization.

Here are four stocks that benefit, according to a money manager. $680,000 contract is for installation and field pilot of the Energy Management Module (‘EMM’) on 40 Chevrolet Bolts within the D.C. As investors prepare for a sustained bull run in 2022, following a rocky 2022, it’s imperative to keep an eye on the market and reevaluate one’s portfolio.

Mullen Automotive, Inc., an electric vehicle company, manufactures and distributes electric vehicles. Its products include passenger electric vehicles and commercial vehicles; and provides solid-state polymer battery technology. The company is headquartered in Brea, California. It also operates CarHub, a digital platform that leverages AI to offer an interactive solution for buying, selling, and owning a car; and provides battery technology and emergency point-of-care solutions.

The company was founded in 2014 and is based in Brea, California. Mullen Automotive Inc. is a southern California-based electric vehicle company, which engages in the manufacture of passenger electric vehicles and commercial vehicles. The company was founded on April 20, 2010 and is headquartered in Brea, CA. Mullen Automotive, Inc. is an electric vehicle company that operates in various verticals of businesses focused within the automotive industry. It is engaged in building passenger electric vehicles , and a portfolio of commercial vehicles.

We’d like to share more about how we work and what drives our day-to-day business. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. MULN does not currently have a forward dividend yield.